What is PMEGP Loan Scheme

The Prime Minister’s Employment Generation Program (PMEGP) loan scheme has emerged as a powerful tool to boost entrepreneurship in India. This initiative, spearheaded by the Khadi and Village Industries Commission (KVIC), aims to create sustainable self-employment opportunities across the country. What is PMEGP loan scheme? It’s a credit-linked subsidy program that provides financial support to individuals looking to start their own micro-enterprises.

Aspiring entrepreneurs can access the PMEGP e-portal to apply for this scheme, which offers substantial benefits to eligible candidates. The program covers a wide range of industries and sectors, making it accessible to diverse business ideas. This article will explore the key aspects of the PMEGP loan scheme, including its eligibility criteria, application process, and the role of the Entrepreneurship Development Program in preparing beneficiaries. We’ll also delve into the importance of a well-crafted project report in securing PMEGP funding.

Overview of PMEGP Loan Scheme

The Prime Minister’s Employment Generation Program (PMEGP) is a credit-linked subsidy scheme introduced by the Government of India in 2008-09. It was created by merging two existing schemes: the Prime Minister’s Rojgar Yojana (PMRY) and the Rural Employment Generation Program (REGP). The PMEGP aims to generate employment opportunities in both rural and urban areas through the establishment of micro-enterprises.

Objectives of PMEGP Loan Scheme

The PMEGP Loan Scheme has several key objectives:

- To create self-employment opportunities in rural and urban areas by setting up new ventures and micro-enterprises.

- To bring together dispersed traditional artisans and unemployed youth, providing them with self-employment opportunities in their local areas.

- To offer continuous and sustainable employment to traditional artisans and unemployed youth, helping to reduce migration from rural to urban areas.

- To increase the wage-earning capacity of workers and artisans, contributing to the growth of rural and urban employment.

Implementing Agencies

The PMEGP is implemented through a network of agencies at various levels:

- National Level: The Khadi and Village Industries Commission (KVIC) acts as the single nodal agency.

- State Level: The scheme is implemented through State KVIC Directorates, State Khadi and Village Industries Boards (KVIBs), and District Industries Centers (DICs).

- Financial Institutions: Public sector banks, regional rural banks, cooperative banks, and private sector scheduled commercial banks regulated by the RBI participate in the scheme.

Funding Structure

The PMEGP provides financial assistance in the form of margin money subsidy:

- Maximum project cost: Rs. 25 lakhs for manufacturing units and Rs. 10 lakhs for service units.

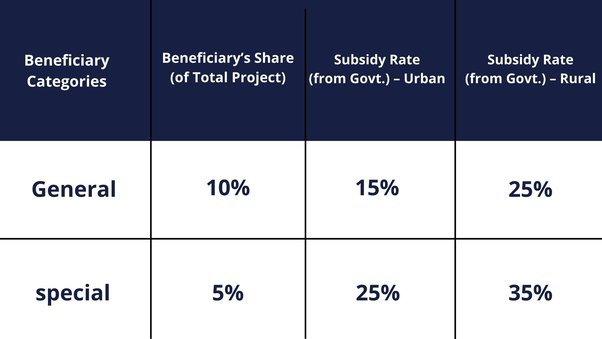

- Subsidy rates:

- General category: 15% (urban areas) and 25% (rural areas) of the project cost.

- Special categories (SC/ST/OBC/Minorities/Women/Ex-servicemen/Physically handicapped/NER/Hill and Border areas): 25% (urban areas) and 35% (rural areas) of the project cost.

- Beneficiary contribution: 10% for general category and 5% for special categories.

- The remaining amount is provided by banks as term loans.

The PMEGP has proven to be instrumental in boosting the growth of the MSME sector and enhancing the economic scenario of the country.

Eligibility Criteria for PMEGP Loan

The Prime Minister’s Employment Generation Program (PMEGP) has specific eligibility criteria for individuals and institutions seeking financial assistance. These criteria ensure that the scheme benefits those who need it most and aligns with its objectives of promoting entrepreneurship and self-employment.

Individual Eligibility

- Age Requirement: Any individual above 18 years of age is eligible to apply for assistance under PMEGP.

- Educational Qualification: For projects costing above Rs. 10 lakh in the manufacturing sector and above Rs. 5 lakh in the business/service sector, applicants should have at least an 8th standard pass educational qualification.

- Income Ceiling: There is no income ceiling for assistance under PMEGP.

- Family Restriction: Only one person from a family can obtain financial assistance for setting up a project under PMEGP. The ‘family’ includes self and spouse.

- Previous Assistance: Existing units and those that have already availed any Government Subsidy (under PMRY, REGP, PMEGP, CMEGP, or any other scheme of Government of India or State Government) are not eligible.

Institutional Eligibility

PMEGP Loan Scheme also extends eligibility to certain institutions:

- Self Help Groups (including those belonging to BPL, provided they have not availed benefits under any other scheme).

- Institutions registered under the Societies Registration Act, 1860.

- Production Co-operative Societies.

- Charitable Trusts.

Project Cost Limits

The PMEGP scheme has specific guidelines regarding project costs:

- Maximum Project Cost: Rs. 50 lakhs for manufacturing units and Rs. 20 lakhs for service units.

- Components of Project Cost: It includes Capital Expenditure (Term Loan), working capital, and the beneficiary’s own contribution.

- Own Contribution: 10% of the project cost for the general category and 5% for special categories (including SC/ST/OBC/Minorities/Women/Transgender, Ex-servicemen, Physically handicapped, NER, Hill and Border areas, etc.).

- Land Cost Exclusion: The cost of land should not be included in the project cost.

- Workshed/Workshop: Cost of ready-built or long-lease or rental workshed/workshop can be included in the project cost, restricted to a maximum period of 3 years.

- Capital Expenditure Requirement: Projects without Capital Expenditure are not eligible for financing under the scheme.

Application Process for PMEGP

Online Application Procedure

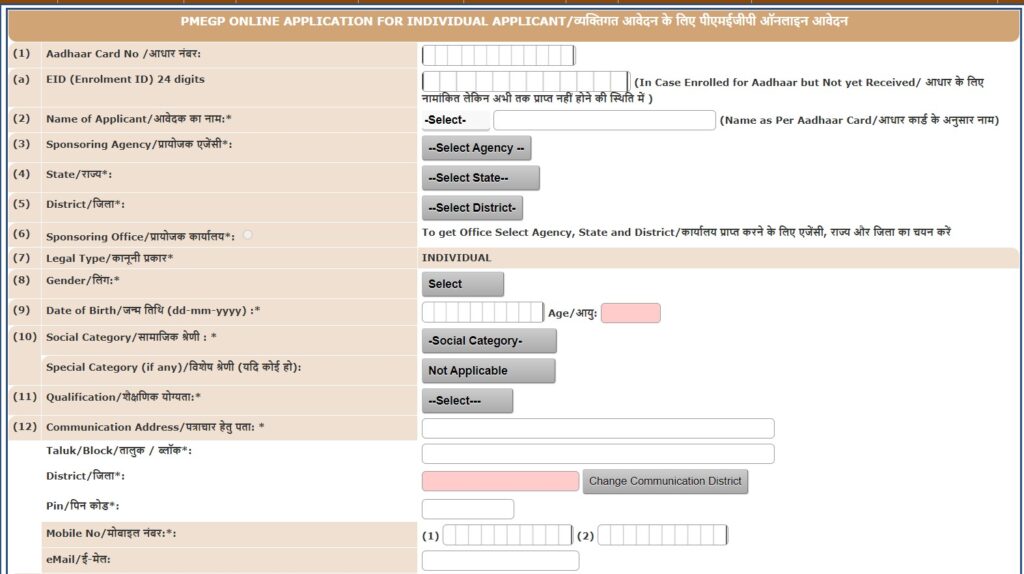

The Prime Minister’s Employment Generation Program (PMEGP) has transitioned to a mandatory online application process since May 1, 2016. Aspiring entrepreneurs can now apply through the official PMEGP e-portal, which offers a user-friendly interface for both individual and institutional applicants.

The online application process involves several steps:

- Eligibility Check: Applicants must first verify their eligibility for the scheme.

- Aadhaar Authentication: Applicants need to validate their Aadhaar details online. In cases where Aadhaar is unavailable, a PAN card or operational bank account number may be used.

- Registration: Upon initial registration, applicants receive a User ID and Password via SMS to their registered mobile number.

- Application Filling: Applicants log in to the PMEGP portal to complete the application form, which includes a one-page format with guidelines for each column.

- Document Upload: Necessary documents are uploaded to the portal.

- Score Card: Applicants fill out a score card and verify their details.

- Final Submission: After reviewing all information, applicants submit their application.

The PMEGP portal also provides additional resources such as FAQs, video tutorials, and a project report template to assist applicants.

Required Documents

To complete the PMEGP application, the following documents are required:

- Passport-sized photograph.

- Proof of highest educational qualification.

- Project report summary or detailed project report.

- Social or special category certificate (if applicable).

- Rural area certificate (if applicable).

- PAN card and Aadhaar card.

- VIII Pass certificate.

- Entrepreneurship Development Program (EDP) training certificate.

- Certificates of academic and technical courses (if applicable).

For institutional applicants, additional documents are required:

- Registration certificate

- Authorization letter or copy of bylaws

- Special category certificate (if applicable)

Task Force Committee

A District Level Task Force Committee (DLTFC) is established to scrutinize the applications. The committee comprises:

- District Magistrate/Deputy Commissioner/Collector (Chairman)

- Project Director – DRDA / Executive Officer – Zilla Panchayat (Vice Chairman)

- Lead Bank Manager

- Representatives from KVIC/KVIB/DIC, NYKS/SC/ST Corporation, MSME-DI, ITI/Polytechnic

- Three Panchayat representatives

- General Manager, DIC of the District (Member Convener)

The DLTFC reviews applications forwarded by district-level agencies (KVIC/KVIB/DIC) after preliminary scrutiny. The committee’s role is to ensure that applications meet scheme guidelines and are complete before forwarding them to financing banks.

Conclusion

The Prime Minister’s Employment Generation Program (PMEGP) loan scheme has proven to be a game-changer for aspiring entrepreneurs in India. By offering financial support and guidance, it has a significant impact on fostering self-employment and boosting the growth of micro-enterprises across urban and rural areas. The scheme’s comprehensive approach, from providing subsidies to organizing training programs, equips beneficiaries with the tools they need to succeed in their ventures.

For those looking to start their own business, the PMEGP presents a golden opportunity to turn dreams into reality. The straightforward eligibility criteria and streamlined online application process make it accessible to a wide range of individuals and institutions. To get started on your entrepreneurial journey, apply with us. Remember, a well-prepared project report and proper documentation are key to increasing your chances of approval under this transformative scheme.